Whether its an out-of-court settlement or an award from a judge or jury plaintiffs do not have to pay taxes on non-pecuniary damages. Unlike other awardsrewards such as points gift cards and vouchers which your employees must claim as taxable income service and safety achievement awards when a part of a conforming plan are not considered a taxable benefit.

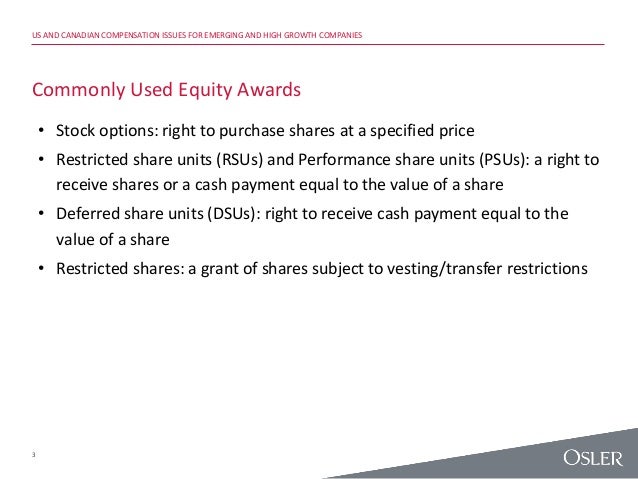

Us And Canadian Compensation Issues For Emerging And High Growth Comp

In general damages awarded are taxable as income from such employment or as a retiring allowance Certain damages discussed below however are non-taxable.

Are awards taxable in canada. Revenu Québec RQ has a gifts and rewards as opposed to CRAs award policy that allows an exemption of unlimited gifts and rewards at fair market value including taxes of 500 annually. As an employer it is sometimes difficult to determine which awarded damages are taxable after an employee is terminated. In 2020 the Tax Court of Canada published its decision for Saunders v The Queen 2020 TCC 114.

The short answer is no. Considering how money paid at the end of the employment relationship can be characterized is a worthwhile exercise for. Where the payment is made directly from the employer to the employees legal adviser this amount is non-taxable.

Tax treatment of scholarships provided to employees or their family members. This valuable and important tax exclusion was at risk of being reversed by the US. This is because plaintiffs do not have to pay taxes on non-pecuniary damages as well as on.

If the social committee itself paid for the prize and the committee is funded entirely by the employees through fundraising activities CRA then any gifts or awards the social committee gives out are non-taxable. Both employees and employers need to take time to consider the structure of the settlement agreement and how to characterize any compensation changing hands. Information on the long-service or anniversary award.

When you exercise your employee stock options a taxable benefit will be calculated. The issue in this case is whether monetary awards received by employees following a successful grievance against their employer is taxable as employment income. Congress in December 2017.

Amounts that are not Taxable Income in Canada Financial windfalls that do not qualify as taxable income are much rarer. A near-cash item is one that functions as cash such as a gift certificate or gift card or an item that can be easily converted to cash such as gold nuggets securities or stocks. Are Awards Taxable A Tax Court of Canada Example.

Gifts awards and long-service awards. Award relates to physical harm almost all of it is taxable at ordinary income rates jul 10 2013 general and special damages for personal injury or death are the most common example non. In short the answer is no.

This article assumes that all services were performed in Canada as an employee of a company as opposed to an independent contractor. Good examples of things that would not be included in taxable income are earnings from gambling where the gambler is not highly organized most income received from gifts or inheritance and lawsuit compensation or damages that are more analogous to windfalls. In reviewing the tax consequences of a settlement essential question is to determine what settlement was intended replace ive won lawsuit and will soon receive large award money damages.

Amounts paid to an employee for the purposes of re-employment counselling are not considered a taxable benefits and are therefore not taxable. Receiving Stock-based Incentives Employee Stock Options ESO from Public Companies and Non-Canadian Controlled Private Companies. The Canadian Revenue AgencyCRA does not consider awards for pain and suffering taxable income.

However if you earn an award which you dont enter it cannot be competed for and is awarded as a mark of honour or distinction then the award is not taxable. Cash or near-cash gifts hospitality rewards manufacturer-provided. Gifts and awards outside our policy.

But if the committee is funded entirely by the employer then any gifts or awards the social committee gives out are taxable benefits. TaxTipsca - Students - Income from scholarships and awards is usually not taxable. Cash and near-cash gifts or awards are always a taxable benefit for the employee.

Rules and policy for gifts and awards. Since the Canadian Revenue Agency CRA does not consider compensation for pain and suffering taxable income you will not have to pay taxes on either out-of-court settlements or settlements awarded by a judge or jury. Since pure incentive travel rewards are considered a taxable benefit they can potentially trigger an unexpected - and unloved - tax hit in the hands of the employee.

While you should always seek professional tax advice for your particular circumstance you can find helpful guidelines in Canada Revenue Agencys Income Tax Interpretation Bulletin IT-470R Consolidated related to Employees. If an employee is given a combined value of 500 of gifts and rewards in a year only the fair market value over 500 needs to be included in the employee. Compensation for legal fees is deductible for employees.

Why Canada S Olympic Medalists Can T Outrun The Taxman Yet Financial Post

![]()

Tax Treatment Of Wrongful Dismissal Awards Employment Human Rights Law In Canada

Canada Requires Non Resident Vendors And Marketplaces To Collect Gst Hst As Of July 1